Ethereum Price: Plunge vs. Rally – What We Know

Generated Title: Ethereum's "Death Cross": Is This the Bottom, or Just the Beginning?

The Ides of ETH?

Ethereum's price action lately has been… concerning. An 8% plunge, Ether ETFs bleeding value, and long-term holders reportedly selling off. That's the headline. But digging into the data, the picture gets more nuanced, and frankly, more interesting. We're seeing ETH test that psychological $3,000 level, a four-month low. And while there's a slight bounce today, the overall trend is undeniably bearish.

One analyst is even forecasting a potential 60% decline. (That's not a typo: sixty percent.) They're pointing to a "death cross" formation – the 50-day EMA about to cross below the 200-day EMA – as a major sell signal. The last time that happened, ETH got hammered. Are we about to repeat history? Ethereum Tracks Bitcoin as ETH Price Prediction Signals Further 60% Drop to April Lows

The Crypto Fear & Greed Index is sitting at a dismal 10, firmly in "extreme fear" territory. And this is the part of the report that I find genuinely puzzling: How can sentiment be this low when, objectively, Ethereum is still making strides? The Fusaka upgrade is on the horizon, promising enhanced scalability. There's even talk of Ethereum enabling AI-driven commerce by 2026. You'd think that kind of innovation would inspire some confidence.

When Whales Swim Against the Tide

But here's the counterpoint: while retail investors might be panicking, there are reports of "strategic whale accumulation amid market volatility." That suggests some big players see this dip as a buying opportunity. Which begs the question: who's right? Are the whales privy to something the rest of us are missing, or are they simply trying to catch a falling knife?

Ethereum's RSI is rebounding from oversold territory, suggesting fading bearish momentum and early signs of recovery. The question becomes, is it a dead cat bounce or the real deal?

The key support level to watch is around $3,017. If ETH can hold that, we might see a recovery towards $3,592. But if it breaks below, the next stop could be $2,749. And if that fails… well, that's when things could get ugly.

Methodological Critique

Let's take a step back and look at how these price predictions are being generated. A lot of it relies on technical analysis – Fibonacci retracement levels, moving averages, and the like. But how reliable are these indicators, really? Are we simply projecting patterns onto random noise? I've looked at hundreds of these charts, and I'm still not convinced that technical analysis is much more than sophisticated astrology.

And consider the "Crypto Fear & Greed Index." It's based on a basket of factors, including volatility, market momentum, social media sentiment, and Google Trends data. But how accurately does it reflect the actual sentiment of Ethereum holders? Are people really as fearful as the index suggests, or are they just bored and waiting for the next bull run?

One analyst, Linh Tran, pointed out that the selling pressure isn't just coming from retail investors, but also from institutional flows, which are "highly sensitive to macroeconomic signals." And that’s the crucial point: Ethereum doesn't exist in a vacuum. It's subject to the same economic forces as everything else.

The Smoke and Mirrors Game

So, what's the takeaway? Is Ethereum doomed to a 60% decline, or is this just a temporary setback? The truth is, nobody knows for sure. The data is contradictory, the indicators are unreliable, and the market is driven by emotions as much as by fundamentals.

But here's what I think: the "death cross" narrative is overblown. Yes, it's a bearish signal, but it's not a guarantee of further decline. And while the Crypto Fear & Greed Index is certainly alarming, it doesn't tell the whole story. There's still plenty of innovation happening in the Ethereum ecosystem, and there are still big players who believe in its long-term potential.

Fear is a Self-Fulfilling Prophecy

So, what's the real story? It's complicated. But one thing is clear: fear is a self-fulfilling prophecy. If everyone panics and sells, then Ethereum will crash. But if enough people hold on, or even buy the dip, then we might just see a recovery. The next few weeks will be crucial.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

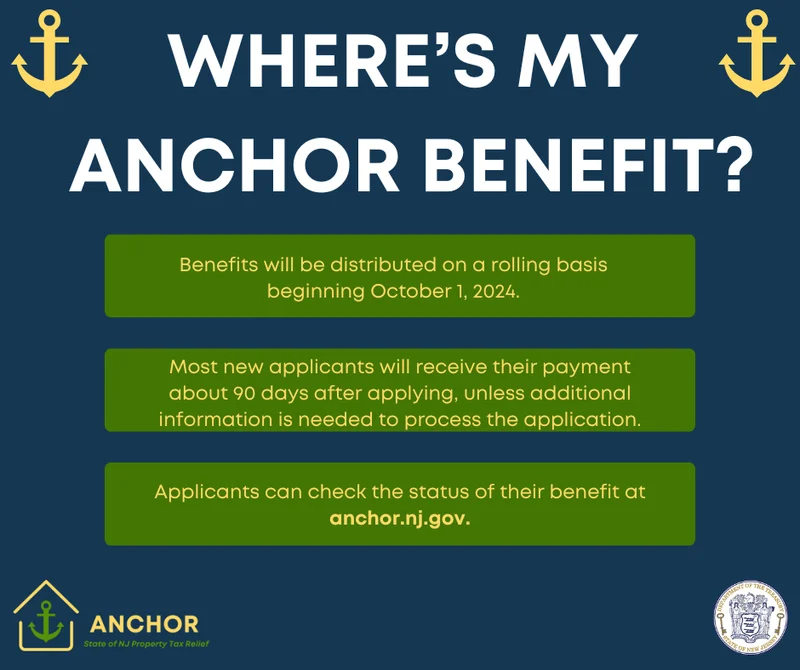

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

- Search

- Recently Published

-

- Netflix Stock: Split Speculation and What It Means – What Reddit is Saying

- Saylor Moon: What's the Deal?

- World Liberty Financial, Trump, and Crypto: What's the Connection?

- Social Security Retirement Age Changes: What to Expect and the Impact – What Reddit is Saying

- Nvidia Stocks: AI Hype vs. Reality

- Ethereum Price: Plunge vs. Rally – What We Know

- Bitcoin's Bear Market: Liquidity Worries vs. Future Potential

- Nvidia Stock Price: What's Driving the Surge and What's Next

- Avelo Airlines' Route Shuffle: What's the Deal?

- Starlink Satellite Count: Orbit Numbers and Falling Concerns

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (6)

- investment advisor (4)

- crypto exchange binance (3)

- ethereum price (3)

- SX Network (3)