Netflix Stock: Split Speculation and What It Means – What Reddit is Saying

Netflix's Stock Split: A Springboard, Not Just a Reset

Netflix's recent 10-for-1 stock split—it's more than just a financial maneuver; it's a signal, a beacon, even, for the future of accessible investment and how we perceive value in the digital age. I know, stock splits aren't exactly the sexiest topic, but stick with me here. This isn't just about making shares cheaper; it's about democratizing access to a company that, let's face it, has fundamentally changed how we consume entertainment.

Leveling the Playing Field

Think about it: for years, owning a slice of Netflix felt like being in an exclusive club. The stock price climbed, and while that's great for early investors, it put it out of reach for many ordinary folks who believe in the company's vision. Now, suddenly, that barrier is lowered. It's like Netflix is saying, "Hey, we want you to be a part of this journey, too."

The official line is that this split aims to make the stock more accessible for employees participating in the company’s stock option program, which is smart, but I think it goes deeper. It's about aligning the company's ownership with its user base. It's about recognizing that the value of Netflix isn't just in its algorithms and content library, but in the millions of subscribers who stream its shows every day.

We've seen other tech giants like Amazon contemplate similar moves. Amazon seeks $12B in bond sale, Netflix trades after stock split, which may be used for acquisitions and CAPEX to share buybacks. What does it say about the market when these powerhouses are thinking about accessibility alongside expansion?

But is it just a gimmick?

Now, I know what some of you are thinking: "A stock split doesn't actually change anything! It's just slicing the same pie into smaller pieces!" And yes, that’s technically true. As Speaker A rightly pointed out in a recent broadcast, splits don't change the value of the company or the dollar amount of equity that each shareholder owns.

But here's where the psychology comes in. A lower price feels more accessible, and that can attract a new wave of investors. It's like putting a sale sticker on something – even if the underlying value is the same, it suddenly becomes more appealing. Plus, it signals confidence. Netflix is essentially saying, "We believe in our future growth, and we want more people to share in that success."

And let's be honest, Netflix needed a bit of a boost. As the report showed, What's Going On With Netflix Stock? - Netflix (NASDAQ:NFLX) Netflix is trading approximately 6.4% below its 50-day moving average of $117.39 and about 2.8% below its 200-day moving average of $113.07, indicating a bearish short-term trend relative to these key indicators. Could this be a way to shake things up?

This is where the real magic happens. Imagine a young person, just starting out, who's always been fascinated by the stock market but intimidated by the high price tags of companies like Netflix, Nvidia, or even Tesla. Now, suddenly, owning a share or two becomes a realistic possibility. That spark of ownership can ignite a lifelong interest in investing, in understanding how businesses work, and in shaping their own financial future. This, to me, is the truly exciting potential of this move.

But, with this newfound accessibility comes a responsibility. It is important to proceed cautiously. To do your research, and to understand the inherent risks involved in stock market investments.

A New Chapter for Netflix?

So, is this just a clever marketing ploy, or is it a genuine step towards democratizing investment? I think it's a bit of both, and honestly, I’m excited to see where this goes. What this means for us is... but more importantly, what could it mean for you? And what kind of innovation are they working on next?

A Future Where Everyone's an Investor

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

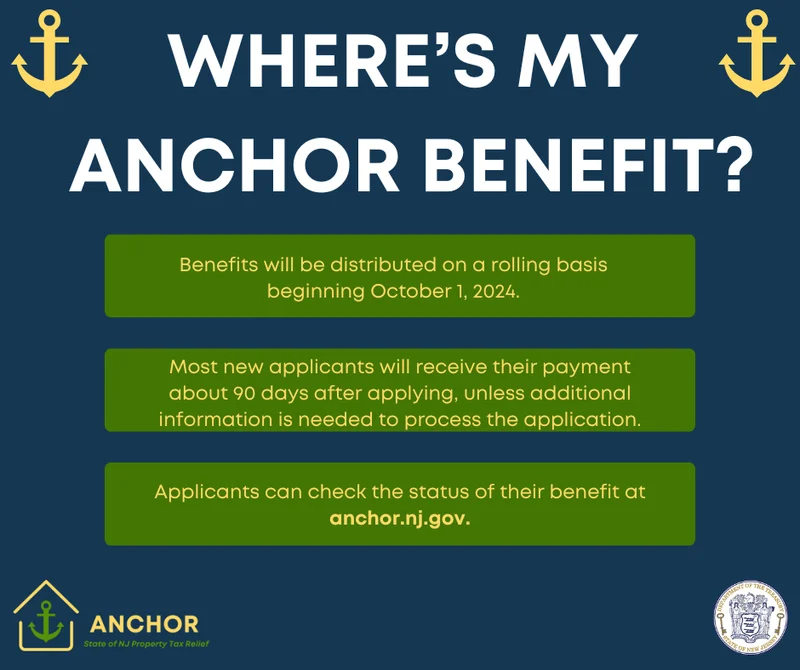

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Netflix Stock: Split Speculation and What It Means – What Reddit is Saying

- Saylor Moon: What's the Deal?

- World Liberty Financial, Trump, and Crypto: What's the Connection?

- Social Security Retirement Age Changes: What to Expect and the Impact – What Reddit is Saying

- Nvidia Stocks: AI Hype vs. Reality

- Ethereum Price: Plunge vs. Rally – What We Know

- Bitcoin's Bear Market: Liquidity Worries vs. Future Potential

- Nvidia Stock Price: What's Driving the Surge and What's Next

- Avelo Airlines' Route Shuffle: What's the Deal?

- Starlink Satellite Count: Orbit Numbers and Falling Concerns

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (6)

- investment advisor (4)

- crypto exchange binance (3)

- ethereum price (3)

- SX Network (3)