World Liberty Financial, Trump, and Crypto: What's the Connection?

Generated Title: Trump's Crypto Pardon: A Billion-Dollar Coin Toss?

Alright, let's break this down. Trump pardoned Changpeng Zhao (CZ), the Binance founder, after CZ's company apparently helped boost a Trump family crypto venture, World Liberty Financial (WLF). The media's calling it corruption. I call it a series of data points that require closer examination.

The Binance-WLF Connection: More Than Meets the Eye?

The core allegation is that Binance provided software to WLF, the Trump family's crypto play, essentially jumpstarting it. Austin Campbell, the former banker, said that without Zhao, “the technology doesn't exist.” World Liberty lawyers admit Binance provided "freely available" software "simply to save WLF from wasting time." Okay, fine. But what kind of software are we talking about here? Was it proprietary, or was it open-source? The details are suspiciously vague. We're talking about a $2 billion investment riding on "saving time"? That sounds like a massive oversimplification.

Then there's the Emirati fund that dumped $2 billion into WLF crypto. "It wasn't strange. It was nuts," said one source. Two billion into a five-week-old currency? That's not just unusual; it's statistically improbable for a legitimate investment. The Emiratis claim "business suitability," which sounds like corporate PR speak. It's like saying a company chose a specific brand of coffee because it tasted "good." It tells you absolutely nothing.

Lessig from Harvard Law said the president is "compromised" by this transaction. Maybe. But "compromised" is an emotional term. Let's rephrase it: the data suggests a potential conflict of interest that requires further scrutiny. The timing of the Emirati investment, the pardon, and Trump's pro-crypto stance all correlate. Correlation isn't causation, but this smells like a very specific, and very expensive, marketing campaign.

The Elephant in the Room: WLFI's Actual Value

The $2 billion question (literally) is what WLF is actually worth. Before the Emirati cash infusion, Austin Campbell said the company was "largely unknown" with a partially filled fundraising round. So, a pre-existing shell company gets a massive cash injection, and suddenly it's a major player? This reminds me of some of the dot-com booms where companies with no real revenue stream got valuations in the billions.

Zhao's Binance left the $2 billion deposited in WLF, potentially earning the Trumps and their partners $80 million a year in interest. Okay, that's a hefty return. But what's the catch? What are the withdrawal terms? Is this locked up for a certain period? The 60 Minutes report doesn't delve into the specifics of the deal, and that's where the real story often lies. I've looked at hundreds of these financial arrangements, and the devil is always in the fine print.

The White House says there are no conflicts of interest. Eric Trump says his father has nothing to do with the company. Michael Gerhardt, the constitutional scholar, disagrees. Who's right? Well, the truth probably lies somewhere in the middle. Trump doesn't need to be involved "day-to-day" to benefit financially. The optics alone are terrible.

And this is the part of the report that I find genuinely puzzling. Trump, on camera, claimed not to know Zhao. Then he defended the pardon, saying "a lot of people" supported it. The disconnect is jarring. Either he's lying (always a possibility), or he's genuinely clueless about the details of a deal that could potentially enrich his family. Which is almost worse.

Pardon Me, But What's the Motive?

Oyer, the former Justice Department pardon vetter, says the administration is using pardons as rewards for friends, allies, and donors. Lessig says there's a "legitimate fear" of private corruption in the executive branch. Again, these are opinions, not hard data. But they're informed opinions, based on years of experience.

The big picture is this: A billionaire with a criminal record gets a pardon. His company may have helped a Trump family business. That business gets a massive investment from a foreign entity shortly before the pardon. The whole thing stinks of something, but what?

A Billion-Dollar Favor or Just Good Business?

It's impossible to say for sure without access to the financial records and internal communications of all parties involved. But the data points to a clear pattern: The Trump family benefits financially from a transaction involving a pardoned individual, and that individual's company benefits from the Trump family's association. Whether that constitutes a crime or simply aggressive business, the court of public opinion may render a different verdict.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

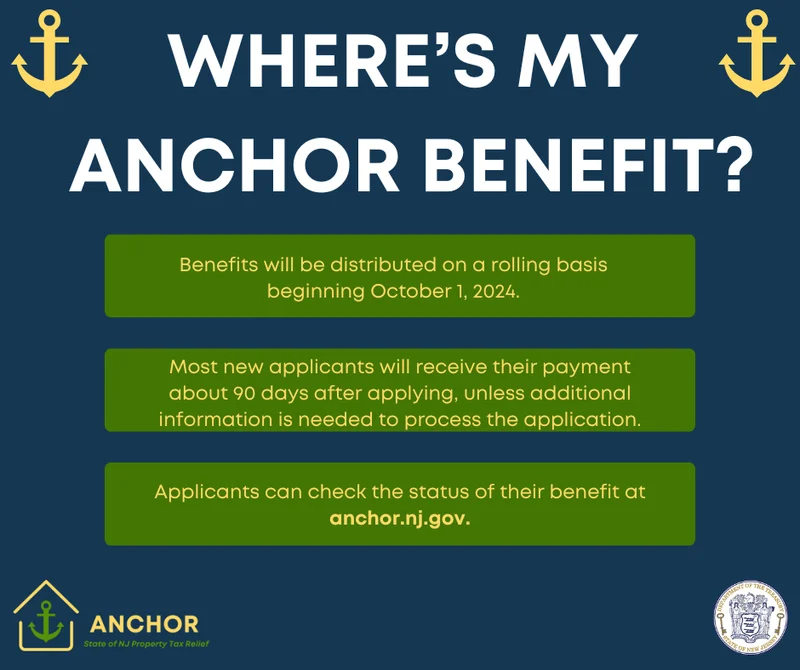

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

- Search

- Recently Published

-

- Netflix Stock: Split Speculation and What It Means – What Reddit is Saying

- Saylor Moon: What's the Deal?

- World Liberty Financial, Trump, and Crypto: What's the Connection?

- Social Security Retirement Age Changes: What to Expect and the Impact – What Reddit is Saying

- Nvidia Stocks: AI Hype vs. Reality

- Ethereum Price: Plunge vs. Rally – What We Know

- Bitcoin's Bear Market: Liquidity Worries vs. Future Potential

- Nvidia Stock Price: What's Driving the Surge and What's Next

- Avelo Airlines' Route Shuffle: What's the Deal?

- Starlink Satellite Count: Orbit Numbers and Falling Concerns

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (6)

- investment advisor (4)

- crypto exchange binance (3)

- ethereum price (3)

- SX Network (3)