Social Security Retirement Age Changes: What to Expect and the Impact – What Reddit is Saying

Social Security in 2026: The Last Big Shift Before a New Era of Retirement?

Alright, everyone, buckle up, because we're about to dive into something that's going to affect millions of Americans, especially those of you eyeing that sweet, sweet retirement. Social Security. It's not always the most thrilling topic, I know, but trust me, there are some pretty significant changes on the horizon for 2026 that are worth paying attention to. And honestly, it's the kind of thing that makes me excited about the future because it forces us to rethink some pretty fundamental assumptions about how we live and work.

The big news? We're looking at a 2.8% cost of living adjustment (COLA) for Social Security recipients starting in January 2026. Now, I know what some of you are thinking: "2.8%? Is that all?" But hold on a second. That translates to an average increase of about $56 per month. That might not sound like a fortune, but for many retirees, that extra bit of income can make a real difference. It’s the difference between choosing the generic brand and the one you actually like, between turning the thermostat up a degree or two when it’s cold, or maybe even treating yourself to a night out. It's real money, folks.

But here’s where it gets really interesting. 2026 marks the last year that the full retirement age (FRA) is being pushed back. For those turning 66 next year, you'll have to wait until you're 67 to claim your full Social Security benefits. Now, before you start groaning, hear me out. This change, while maybe a little annoying in the short term, actually sets the stage for a new era of retirement planning. Think of it like this: for anyone born in 1960 or later, FRA is locked in at 67, unless lawmakers decide to shake things up. This Social Security Change Will Happen for the Last Time in 2026

The Dawn of Retirement Certainty?

What does this mean? It means that future retirees will have a level of certainty that previous generations didn't. You know exactly when you can expect to receive your full benefits. This allows for much more strategic and informed retirement planning. We can finally stop playing this guessing game. It's like going from navigating by the stars to having a GPS—suddenly, the path is much clearer.

And that's not all. The maximum amount of earnings subject to Social Security tax is also going up to $184,500. The earnings limit for workers younger than full retirement age increases to $24,480 (with a $1 deduction for every $2 earned over that amount). For those reaching full retirement age in 2026, the limit jumps to $65,160 (with a $1 deduction for every $3 earned above that), until the month you hit FRA. I know, it sounds like a bunch of numbers, but it’s all part of the bigger picture.

Now, I know there are always skeptics out there. I saw one headline that said, "1 in 5 Americans Are Making a Social Security Mistake That Could Ruin Their Retirement." Okay, that's a little dramatic, don't you think? The article pointed out that many people mistakenly believe Social Security alone will be enough to fund their retirement. And yes, it's true that Social Security was never intended to be a sole source of support. It's meant to be part of a three-legged stool, along with pensions and retirement savings. But I think this "mistake" is born out of a genuine hope that things will be okay. And honestly, with a little planning and a realistic understanding of what Social Security can provide, they can be.

The key is to be informed. Understand your benefits, know your FRA, and plan accordingly. Don't rely solely on Social Security. Start saving early, even if it's just a little bit each month. The power of compounding is real, people!

When I think about all of this, I'm reminded of the invention of the printing press. Before Gutenberg, knowledge was limited to a select few. The printing press democratized information, making it accessible to the masses. Similarly, this increased certainty around Social Security—the fixed FRA for future generations—democratizes retirement planning. It empowers individuals to take control of their financial futures. It's an exciting prospect!

Of course, with this increased certainty comes increased responsibility. We need to educate ourselves, plan wisely, and advocate for policies that support a secure retirement for all. It's not just about us as individuals; it's about building a society where everyone has the opportunity to retire with dignity.

The Future is Finally in Our Hands

I truly believe that 2026 marks a turning point. It's the end of one era and the beginning of another. An era where retirement planning is more predictable, more accessible, and more empowering. Let's seize this opportunity and build a brighter future for ourselves and for generations to come.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

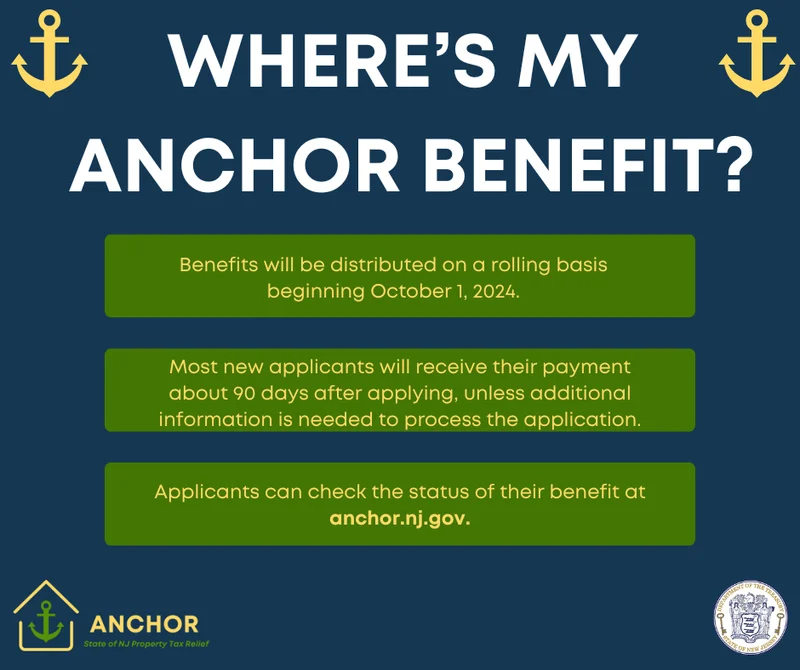

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Netflix Stock: Split Speculation and What It Means – What Reddit is Saying

- Saylor Moon: What's the Deal?

- World Liberty Financial, Trump, and Crypto: What's the Connection?

- Social Security Retirement Age Changes: What to Expect and the Impact – What Reddit is Saying

- Nvidia Stocks: AI Hype vs. Reality

- Ethereum Price: Plunge vs. Rally – What We Know

- Bitcoin's Bear Market: Liquidity Worries vs. Future Potential

- Nvidia Stock Price: What's Driving the Surge and What's Next

- Avelo Airlines' Route Shuffle: What's the Deal?

- Starlink Satellite Count: Orbit Numbers and Falling Concerns

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (6)

- investment advisor (4)

- crypto exchange binance (3)

- ethereum price (3)

- SX Network (3)