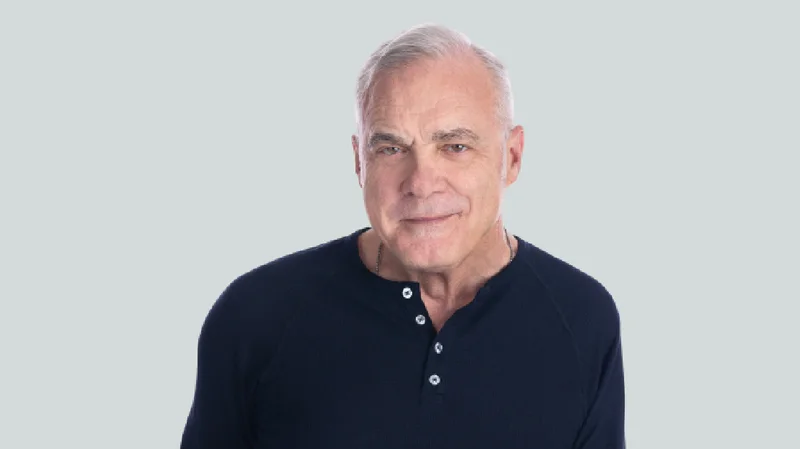

Mark Bertolini's New Chapter: Verizon and Oscar – What We Know

Bertolini's Verizon Move: Genius or Desperate Gamble?

Mark Bertolini, former Aetna CEO and current Oscar Health CEO, is adding another title to his resume: Chairman of Verizon. The move, announced in October, has raised eyebrows across both the healthcare and telecom industries. Is this a stroke of genius, leveraging Bertolini’s experience across sectors, or a sign of Verizon scrambling for a lifeline? The data, as always, offers a more nuanced, if still unclear, picture.

Health Meets Telecom: A Synergistic Dream?

On paper, the rationale isn't completely absurd. Bertolini's experience at Oscar Health, a tech-driven insurer, could, theoretically, bring a fresh perspective to Verizon's customer experience and digital strategy. Oscar, after all, has been trying to reshape healthcare for consumers. As Bertolini himself said, finding the right healthcare coverage should be as easy as buying milk at Hy-Vee. (A sentiment that, frankly, sounds better in a press release than it does in reality.)

His focus on individual coverage health reimbursement arrangements (ICHRAs) at Oscar – efforts to give employees cash to buy their own individual health coverage – could translate to innovative benefit programs at Verizon. The company has over 100,000 employees. If Verizon can make things better for their employees, this move would pay off. But this assumes two things: that ICHRAs are actually as beneficial as proponents claim (the data is still out on that one), and that Verizon's board actually intends to leverage Bertolini's healthcare expertise in any meaningful way.

One could imagine a future where Verizon deeply integrates health and telecom. Maybe offering bundled health and connectivity plans, or using Verizon’s network to improve telehealth services. But these are, at this point, just hypotheticals. And it’s a crowded field. Every major tech company is trying to get in on the healthcare boom. So, what makes this any different?

Oscar's Losses: A Red Flag?

Here's where the data starts to paint a less rosy picture. Oscar Health, while innovative in some areas, hasn't exactly been a beacon of financial stability. The company reported a $137.5 million loss in the third quarter of 2025, compared to a $54.6 million loss in the same quarter of the previous year. That's more than double the loss. Through three quarters of 2025, they’ve posted a $90.5 million loss, reversing a $179 million profit through the first nine months of 2024.

The medical loss ratio (MLR) – the percentage of premiums spent on medical care – also increased, from 84.6% to 88.5%. Higher MLR means less profit for the insurer. While revenue did increase (just shy of $3 billion for the quarter), the rising losses and MLR raise concerns about Oscar's long-term sustainability. It's worth noting that Oscar reaffirmed its full-year guidance, expecting revenue between $12 billion and $12.2 billion, but also anticipating a loss from operations of between $200 million and $300 million.

What I find genuinely puzzling is how Bertolini can balance these different responsibilities. Is he going to focus on Oscar Health or Verizon more? How does he have the time?

This isn't to say Bertolini is solely responsible for Oscar's financial performance, but it does raise questions about his track record. Is Verizon bringing in a turnaround artist, or someone who's simply good at selling a vision? And, perhaps more importantly, is Verizon aware of the potential optics of appointing someone from a struggling healthcare company to a leadership position?

The ACA Tax Credit Wildcard

Adding to the uncertainty is the looming expiration of enhanced premium tax credits for Affordable Care Act (ACA) plans. Bertolini himself has acknowledged this as a potential "reset moment for the individual market." He told investors he was "optimistic" that lawmakers would reach an agreement, but also said the company is bracing for impact.

He noted that people who receive these tax credits generally don't have access to employer-sponsored plans, and that these subsidies are crucial. Without them, monthly costs could jump from $75 to $300 for someone making $60,000 per year. (A parenthetical clarification: that $60,000 figure is an average, and the actual impact would vary based on income and location.)

The weighted average rate increase for Oscar in 2026 is 28% (to be more exact, according to program integrity changes, it's actually 27.9%). It's a combination of expiring tax credits and worsening morbidity that the team attributes to Medicaid enrollees joining the market.

How much of Oscar’s struggles is Bertolini’s fault, and how much of it is the current political environment? It is hard to say for sure, but it does give me pause.

Desperation or Diversification?

Ultimately, the success of Bertolini's move to Verizon hinges on two key factors: Verizon's willingness to embrace change, and Bertolini's ability to deliver results beyond the healthcare sector. Is Verizon desperate enough to try something radically different? Or is this a calculated move to diversify its leadership and tap into new markets? Only time, and the quarterly earnings reports, will tell.

Smoke and Mirrors?

It is too early to tell if this move will pay off for Verizon. But the data suggests that it is more of a gamble than a sure thing. Bertolini has a lot on his plate, and it is hard to see how he will be able to juggle his responsibilities at Oscar Health and Verizon. The market is changing rapidly, and it is unclear if Bertolini has the right skillset to navigate these challenges.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

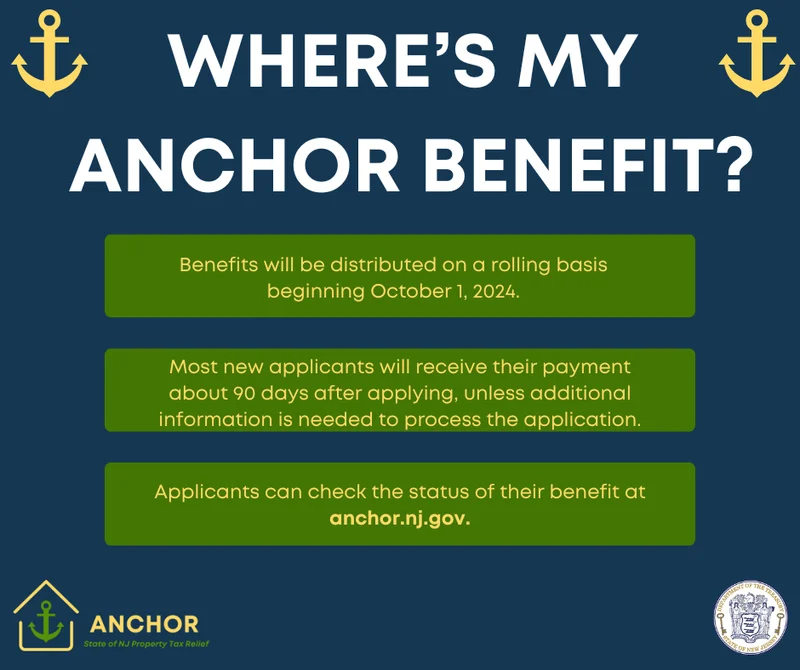

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Netflix Stock: Split Speculation and What It Means – What Reddit is Saying

- Saylor Moon: What's the Deal?

- World Liberty Financial, Trump, and Crypto: What's the Connection?

- Social Security Retirement Age Changes: What to Expect and the Impact – What Reddit is Saying

- Nvidia Stocks: AI Hype vs. Reality

- Ethereum Price: Plunge vs. Rally – What We Know

- Bitcoin's Bear Market: Liquidity Worries vs. Future Potential

- Nvidia Stock Price: What's Driving the Surge and What's Next

- Avelo Airlines' Route Shuffle: What's the Deal?

- Starlink Satellite Count: Orbit Numbers and Falling Concerns

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (6)

- investment advisor (4)

- crypto exchange binance (3)

- ethereum price (3)

- SX Network (3)