Silver Spot Price Today: What's Driving Volatility and the Bitcoin Connection

Silver's Quiet Revolution: Are We Witnessing the Dawn of a New Monetary Era?

Okay, folks, buckle up. We need to talk about silver. Not just the shiny stuff in your grandma’s attic, but the real silver – the one quietly staging a comeback that could reshape our understanding of value itself. On November 11th, 2025, silver hit $51.22 an ounce. A buck thirteen up from the day before. Now, I know what you're thinking: "Aris, it's just a metal." But hear me out, because this is about so much more.

Silver: More Than Just a Pretty Metal

Let's zoom out for a second. One year ago, silver was hovering around $30. Today? Nearly $52. That's a 66.94% leap! And get this, it's outperforming gold this year, which, for those of you who follow the markets, is like your little brother suddenly dunking on LeBron. Since the start of the year, silver has climbed nearly 25%.

Now, I know what some of the cynics are saying. I saw one headline that screamed, "Silver Still Underperforms S&P 500 by 96%!" Okay, fair point, historically. Since 1921, silver has lagged behind the stock market. But here's the thing: the world has changed. The old rules are being rewritten. We're talking about a world drowning in printed money, where traditional "stores of value" are being questioned. In a world like that, what does it mean to be a store of value? Is it about keeping pace with the S&P 500, or is it about holding its value when everything else is going haywire?

Silver's volatility – remember, it's used in everything from electronics to solar panels – means it's more reactive to economic shifts than gold. Think of it like this: gold is the steady oak tree, silver is the willow, bending with the wind but rarely breaking. And that “wind” is the increasing demand for silver in green technologies. What happens when suddenly everyone needs a metal that's both a monetary asset and a critical component of the future economy? Could this be the catalyst that finally allows silver to outshine its reputation?

We're seeing narrow "price spreads" – the difference between what buyers are willing to pay and sellers are willing to accept. That's a telltale sign of serious demand. People aren't just kicking tires; they're ready to buy.

What does this all mean for us, the everyday folks trying to navigate an increasingly uncertain financial landscape? Well, imagine a future where your investments aren't just numbers on a screen, but tangible assets that hold their value, regardless of what the Fed decides to do next.

And there's more to the story here than just prices. Platinum and palladium, often seen as silver's volatile cousins, are also showing strength. This isn’t just about one metal; it's about a broader shift in how we perceive and value these fundamental elements. Could this be the start of a new paradigm, where precious metals regain their status as a cornerstone of financial stability?

Silver Lining or Fool's Gold?

Look, I'm not saying silver is a guaranteed path to riches. Nothing is. But I am saying that something significant is happening, and it's worth paying attention to. This isn't just about investment; it's about questioning our assumptions, challenging the status quo, and daring to imagine a different kind of future. A future where real assets matter, where scarcity has value, and where the "quiet revolution" of silver might just be the loudest wake-up call we've had in a long time. It’s the kind of breakthrough that reminds me why I got into this field in the first place.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

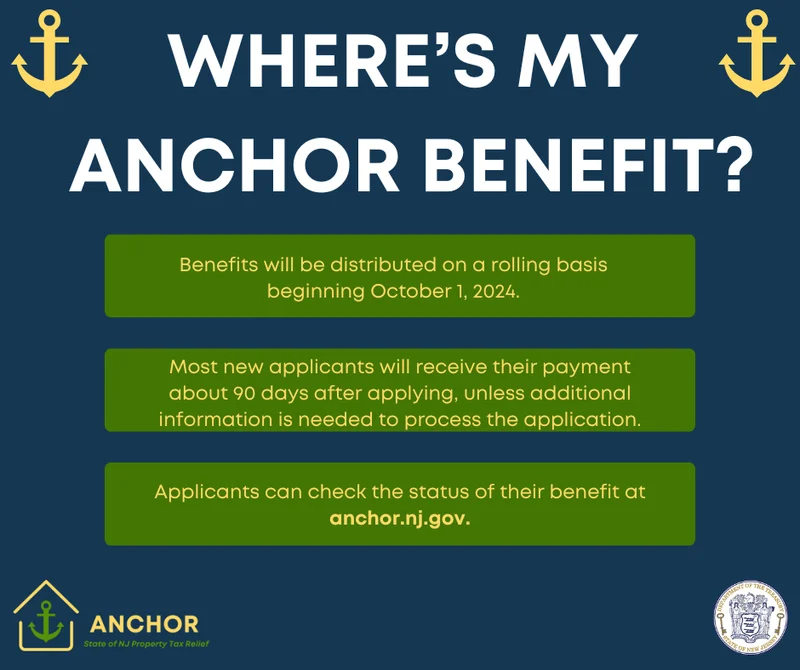

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

- Search

- Recently Published

-

- Netflix Stock: Split Speculation and What It Means – What Reddit is Saying

- Saylor Moon: What's the Deal?

- World Liberty Financial, Trump, and Crypto: What's the Connection?

- Social Security Retirement Age Changes: What to Expect and the Impact – What Reddit is Saying

- Nvidia Stocks: AI Hype vs. Reality

- Ethereum Price: Plunge vs. Rally – What We Know

- Bitcoin's Bear Market: Liquidity Worries vs. Future Potential

- Nvidia Stock Price: What's Driving the Surge and What's Next

- Avelo Airlines' Route Shuffle: What's the Deal?

- Starlink Satellite Count: Orbit Numbers and Falling Concerns

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (6)

- investment advisor (4)

- crypto exchange binance (3)

- ethereum price (3)

- SX Network (3)