Netflix Stock Price: What the Hell is Going On?

Netflix's Stock Split: A Desperate Hail Mary or Genius Move?

Alright, here we go again. Netflix doing the 10-for-1 stock split thing. Is this some kind of magic trick to distract us from the fact that they’re still charging me extra for sharing my password with my own damn family? Probably.

The Split: Smoke and Mirrors?

Let's be real, stock splits are usually just cosmetic surgery for companies that think their stock price is getting too "intimidating" for the little guys. Oh no, a four-figure stock price! How will the poors ever afford a single share? Give me a break. It's like putting lipstick on a pig, hoping no one notices it's still, well, a pig.

Netflix is currently chilling at $1112.17 a share. After the split, it’ll be around $111. Makes it seem cheaper, right? More accessible? Maybe. But it doesn’t actually do anything to the underlying value of the company. It's just slicing the pizza into more slices. You still got the same amount of pizza!

And speaking of smoke and mirrors, let's not forget that little "oopsie" in the third quarter. A $619 million charge because of a Brazilian tax dispute? Seriously? That’s not exactly confidence-inspiring. They try to bury it in the press release, hoping we'll all be too busy drooling over the stock split news to notice. Nice try, fellas.

The Ad Revenue Hype Train

Okay, okay, I'll give them some credit. Their ad revenue is supposedly going to "more than double" in 2025. We're talking about 190 million monthly active viewers subjected to ads. That's a lot of eyeballs. Are those eyeballs happy about it? Doubtful. But Netflix ain't exactly known for caring about our happiness, are they? As long as those sweet, sweet ad dollars keep rolling in...

But wait a second. More than double, huh? Compared to what? They don't exactly give us the specifics. Plus, everyone and their mother is launching a streaming service with ads now. Peacock, Paramount+, Disney+... it's a freakin' ad-pocalypse. Netflix thinks they're gonna dominate this space? I'm not so sure. Maybe I'm just being cynical, but...

The real question is, will this ad revenue actually offset the people who cancel their subscriptions because they're sick of seeing ads on a service they already pay for? Or are they just squeezing us for every last penny?

History Doesn't Always Repeat Itself

Now, I’ve seen some analysts saying that stocks priced above $400 before a split tend to outperform in the long run. Average return of 17.4% versus 9.8% for the S&P 500. Sounds great, right? Except, past performance doesn’t guarantee future results. That's like saying because I won a poker hand last night, I’m guaranteed to win tonight. Good luck with that strategy. Some analysts, however, maintain that there are 4 Reasons Netflix Stock Is a Buy Today.

And let's talk about that price-to-earnings ratio. 47? A forward multiple of 37? That's not exactly cheap. Are we sure this stock is worth that much? Or are we just caught up in the hype, the "Netflix and chill" culture that's been drilled into our brains for the last decade?

Offcourse, the company is still growing, even if the pace is slowing down. 17.2% revenue growth in Q3. They're projecting a 29% operating margin in 2025. But is that enough to justify the current valuation? I don't know, man. I really don't. Maybe I'm just missing something here. But this whole thing feels… shaky.

So, What's the Real Story?

Netflix is betting big on ads and hoping a stock split will reignite investor enthusiasm. But let's be honest, this feels more like a desperate attempt to prop up a bloated valuation than a genuine move towards long-term growth. The Brazilian tax thing stinks. The ad revenue numbers are vague. And the whole "stock split = instant riches" narrative is just plain insulting to anyone with half a brain. Netflix ain't fooling anyone.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

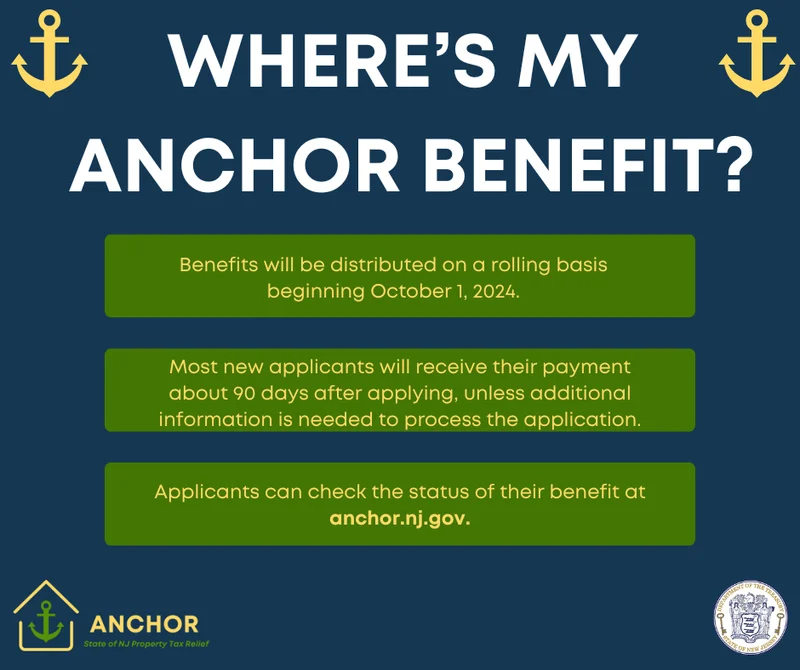

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Netflix Stock: Split Speculation and What It Means – What Reddit is Saying

- Saylor Moon: What's the Deal?

- World Liberty Financial, Trump, and Crypto: What's the Connection?

- Social Security Retirement Age Changes: What to Expect and the Impact – What Reddit is Saying

- Nvidia Stocks: AI Hype vs. Reality

- Ethereum Price: Plunge vs. Rally – What We Know

- Bitcoin's Bear Market: Liquidity Worries vs. Future Potential

- Nvidia Stock Price: What's Driving the Surge and What's Next

- Avelo Airlines' Route Shuffle: What's the Deal?

- Starlink Satellite Count: Orbit Numbers and Falling Concerns

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (6)

- investment advisor (4)

- crypto exchange binance (3)

- ethereum price (3)

- SX Network (3)