Zillow's Homeownership Cost Report: What's the Real Damage?

Homeownership: The American Nightmare?

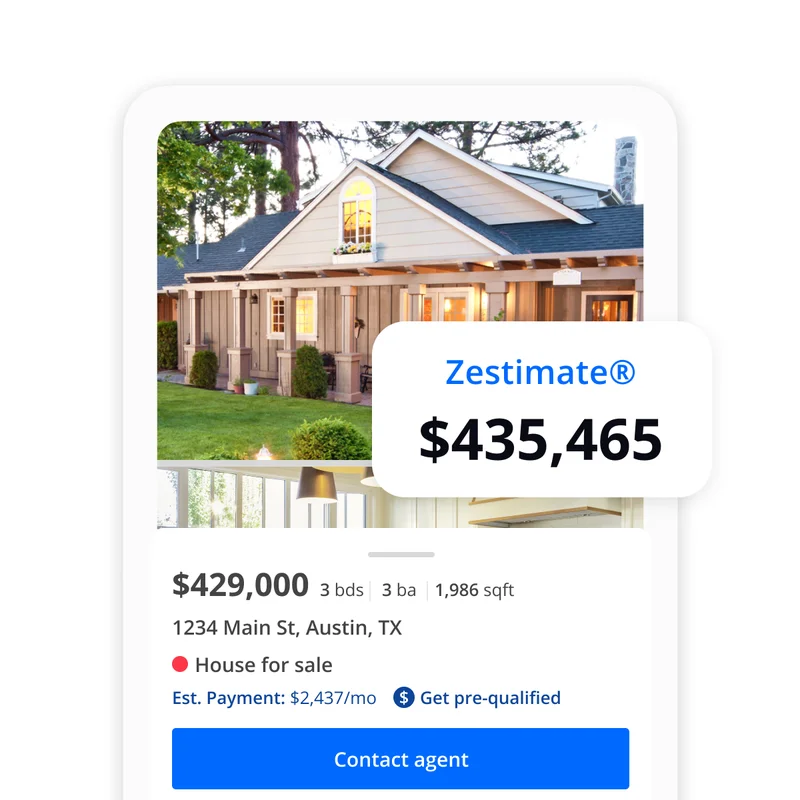

So, Zillow's out with another "study" – if you can even call it that – telling us the hidden costs of owning a home are skyrocketing. Surprise, surprise. Next they'll tell us water is wet. $16,000 a year, they say? That's just the average. I bet that number is a flat-out lie for anyone living in a decent-sized city.

The Illusion of Ownership

Let's be real: owning a home ain't what it used to be. It's not the cornerstone of the American Dream; it's more like a gilded cage. You're basically a glorified renter, except instead of a landlord, you're beholden to the bank, the insurance company, the taxman, and every two-bit contractor in a 50-mile radius.

Zillow and Thumbtack team up for this analysis, and Thumbtack's "home expert" Morgan Olsen says, "Home maintenance is often one of the most overlooked parts of owning a home..." No freakin' kidding! It's overlooked because nobody wants to think about it! You spend your life savings on a down payment, then you gotta shell out another ten grand a year just to keep the place from falling apart? Seriously?

And don't even get me started on property taxes. Paying for schools I don't use, roads that are always under construction, and cops who are too busy writing tickets to catch actual criminals... It's highway robbery, plain and simple.

Coastal Catastrophes and Insurance Insanity

Of course, the biggest costs are in the coastal cities – New York, San Francisco, Boston. No shocker there. But Florida? Man, that's a whole different level of messed up. Insurance premiums in Miami up 72% since 2020? What the hell is going on down there? Are the insurance companies just straight-up price gouging because of the hurricanes? Offcourse, they are.

Kara Ng, Zillow's senior economist, says insurance costs are "a barrier to entry for aspiring first-time buyers." Ya think? It's not just a barrier; it's a freakin' wall. A wall made of paperwork, red tape, and exorbitant fees. They expect us to believe this nonsense, and honestly... I'm starting to think the whole system is rigged against anyone who isn't already rich.

I remember when my parents bought their first house. It was a modest little thing, but it was theirs. They worked hard, saved their money, and made it happen. Now? Good luck. You need a six-figure salary, a perfect credit score, and the willingness to sell your soul to get a mortgage.

Wait, are we supposed to feel bad for homeowners? Nah.

Zillow's "Helpful" Tips? Give Me a Break.

And then Zillow has the nerve to offer "tips" for prospective buyers. "Know your true buying power." "Plan for maintenance costs early." "Reconsider the type of home you buy." As if we haven't thought of all that already. It's like telling a drowning man to just breathe underwater. According to Hidden costs of homeownership reach $16K per year, these costs can reach $16,000 annually.

Honestly, maybe renting is the way to go. At least you know what you're getting into, and you don't have to worry about the roof caving in or the plumbing exploding. Plus, you can move whenever you want, without having to deal with the hassle of selling.

Then again, maybe I'm just being cynical. Maybe there's still hope for the American Dream. Maybe someday, owning a home won't be a financial death sentence. But let's be real, what are the odds?

The American Dream is Officially Dead

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

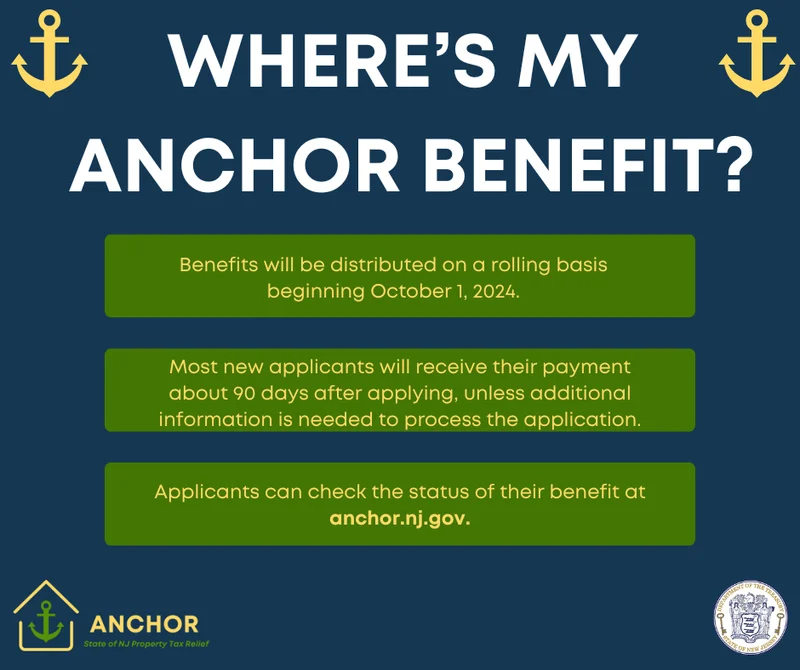

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

- Search

- Recently Published

-

- Netflix Stock: Split Speculation and What It Means – What Reddit is Saying

- Saylor Moon: What's the Deal?

- World Liberty Financial, Trump, and Crypto: What's the Connection?

- Social Security Retirement Age Changes: What to Expect and the Impact – What Reddit is Saying

- Nvidia Stocks: AI Hype vs. Reality

- Ethereum Price: Plunge vs. Rally – What We Know

- Bitcoin's Bear Market: Liquidity Worries vs. Future Potential

- Nvidia Stock Price: What's Driving the Surge and What's Next

- Avelo Airlines' Route Shuffle: What's the Deal?

- Starlink Satellite Count: Orbit Numbers and Falling Concerns

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (6)

- investment advisor (4)

- crypto exchange binance (3)

- ethereum price (3)

- SX Network (3)