Blockchain: Google's 'Crazy Tool' vs. Franklin Templeton's Benji Token

Google's Quantum Money: Is This the End of Blockchain Hype?

Quantum Leap or Quantum Mirage?

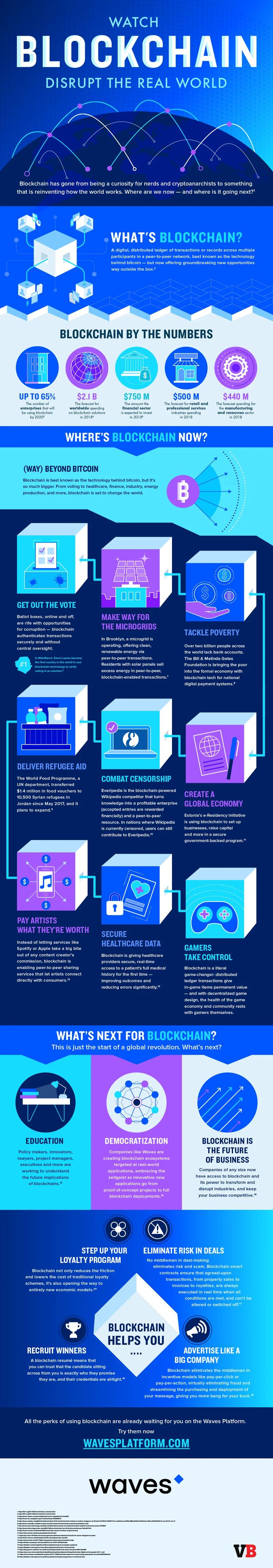

Google's quantum AI team is making noise again, this time with a proposal for a quantum-secured digital currency. The core idea, detailed in their paper "Anonymous Quantum Tokens with Classical Verification," is to use quantum mechanics to make digital tokens that are physically impossible to copy. That’s the claim, anyway. This approach, if it pans out, would sidestep the "double-spend" problem that blockchain currently solves with distributed ledgers and massive amounts of computing power.

The allure is obvious. Bitcoin, for all its disruptive potential, is still fundamentally reliant on computational difficulty. You make it computationally infeasible to counterfeit or double-spend. Quantum money, in theory, makes it physically impossible. Dar Gilboa from Google calls it a "crazy tool" with "high risk, high reward." Google's 'Crazy Tool' Could Make Blockchain Obsolete – Experts Suggest 'Wild' And 'Exciting' Times Ahead Amid 'High Risk, High Reward' Endeavor - Yahoo Finance High risk is right; the question is whether the reward is actually there, or just a mirage shimmering in the desert of theoretical physics.

The current system that blockchain uses prevents "double-spend" by maintaining a public and permanent accounting system. Every transaction is recorded, verified, and added to the chain. This requires a consensus mechanism (like proof-of-work or proof-of-stake) that, in turn, demands significant energy consumption and processing power. Quantum money, in contrast, proposes a system where each token is unique and physically unclonable. If you try to copy it, you destroy the original. This eliminates the need for a distributed ledger, theoretically.

The Devil's in the Qubits

The Google team's protocol involves a "bank" that distributes these quantum tokens. The tokens themselves can be verified using classical operations (that is, regular computers). This is crucial because it means you don't need a quantum computer in your pocket to use this currency. But here's where my skepticism kicks in. (I've looked at enough "revolutionary" technologies to know where the bodies are buried.)

The paper doesn't specify how this "bank" creates and distributes these unclonable quantum tokens in a practical, scalable way. That's a pretty big omission. Creating a handful of these tokens in a lab is one thing; issuing them to millions of users is something else entirely. What are the error rates? How long do these quantum states last before decoherence kicks in and the token becomes unusable? What's the infrastructure cost?

This is where the "high risk" Gilboa mentioned becomes very real. Quantum computing is still in its infancy. Building stable, fault-tolerant quantum systems is an enormous engineering challenge. The current generation of quantum computers are notoriously finicky and prone to errors. Expecting them to underpin a global currency anytime soon seems… optimistic.

And this is the part of the report that I find genuinely puzzling: the lack of concrete details on the practical implementation. It's all theoretical at this point. The paper focuses on the cryptographic protocol, not the nuts and bolts of building a quantum money system. That's fine for a research paper, but it leaves a gaping hole in terms of real-world viability.

It's also worth remembering that blockchain, despite its flaws, has a decade-long head start. A vast ecosystem of developers, companies, and users has grown around it. Overthrowing that with a completely different technology is a monumental task. The blockchain community is not monolithic, but the network effect is strong.

Is This the Blockchain Killer?

Google's quantum money research is undeniably interesting. It challenges the technological foundation that has supported cryptocurrencies like Bitcoin for over a decade. But let’s be clear: this is still very early-stage research. There are huge practical hurdles to overcome before quantum money becomes a viable alternative to blockchain. The lack of details regarding scalability and error rates, in particular, raises serious questions. It's a "crazy tool" alright, but right now, it looks more like a theoretical curiosity than a genuine threat to the crypto establishment.

The Hype Exceeds the Reality (For Now)

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

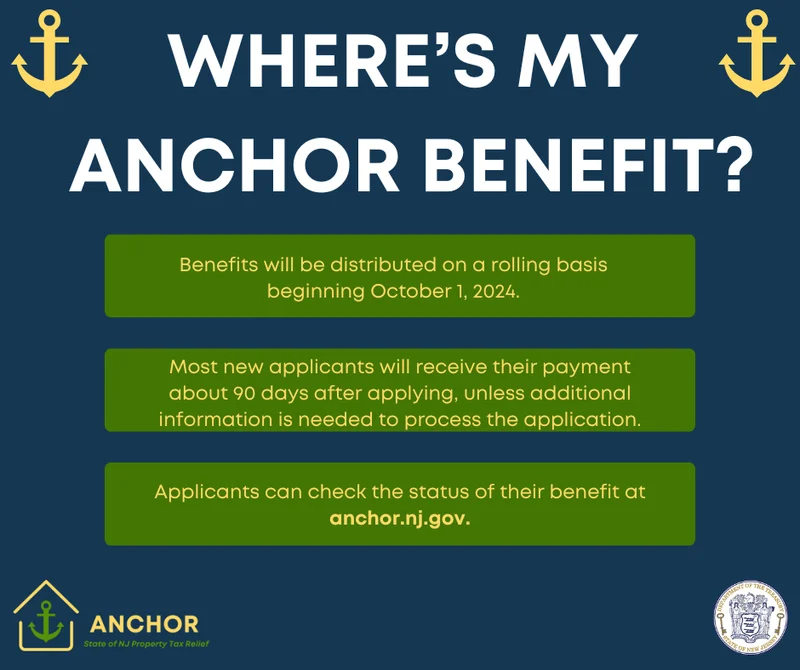

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Netflix Stock: Split Speculation and What It Means – What Reddit is Saying

- Saylor Moon: What's the Deal?

- World Liberty Financial, Trump, and Crypto: What's the Connection?

- Social Security Retirement Age Changes: What to Expect and the Impact – What Reddit is Saying

- Nvidia Stocks: AI Hype vs. Reality

- Ethereum Price: Plunge vs. Rally – What We Know

- Bitcoin's Bear Market: Liquidity Worries vs. Future Potential

- Nvidia Stock Price: What's Driving the Surge and What's Next

- Avelo Airlines' Route Shuffle: What's the Deal?

- Starlink Satellite Count: Orbit Numbers and Falling Concerns

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (6)

- investment advisor (4)

- crypto exchange binance (3)

- ethereum price (3)

- SX Network (3)