Firo Hard Fork: What to Expect

FIRO's Privacy Play: Pump or Sustainable Surge?

FIRO, a cryptocurrency focused on privacy, has seen a massive price surge recently, up 450% since September. The question is, can it hold those gains, or is this just another flash in the pan driven by hype? Let's dig into the numbers and see what's really going on.

The headlines scream about FIRO testing the $3 resistance level, a ceiling it hasn't decisively broken in three years. The article notes that a break above $3 could lead to an "accelerated" upward movement, potentially hitting $4.80. But here's the thing: FIRO has poked above this resistance before, only to be swatted back down. So, what's different this time? Is it just wishful thinking fueled by the upcoming hard fork on November 19? Firo to Undergo Hard Fork on on November 19

Momentum indicators like the Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) are cited as bullish. They're rising, but—and this is crucial—they're also overbought. The article downplays this, saying there's no bearish divergence yet. But that's like saying a car speeding towards a brick wall is fine because it hasn't crashed yet. The risk is clearly elevated.

Social sentiment is another piece of the puzzle. While interest in FIRO is described as "organic" (meaning it's not just celebrity endorsements driving the price), mentions are still low relative to the price increase. The article admits FIRO remains "relatively obscure." This raises a red flag. A genuine, sustainable price increase is usually accompanied by broader awareness and adoption, not just a few enthusiastic forum posts.

A Deeper Dive into On-Chain Utility

Now, a more recent article (dated November 14, 2025, oddly enough, placing this article in the future) points to a different factor: the launch of Spark Assets. This allows developers to create privacy-focused tokens on the FIRO network. The claim is that this turns FIRO into a "privacy infrastructure layer," boosting its utility.

The argument is that every Spark Asset creation or private transaction requires FIRO tokens, driving demand. Early metrics supposedly show rising daily active addresses and higher transaction volumes. This is the kind of data I want to see. However, the numbers are still missing. How much have daily active addresses risen? What are the actual transaction volumes? Without those figures, it's just marketing fluff.

The article also mentions the upcoming hard fork, which will enable Spark Name transfers and lower GPU VRAM mining requirements. This could attract more miners and users, but it's still just potential. (And this is the part of the report that I find genuinely puzzling—why lower GPU VRAM requirements? Is the goal to become more decentralized, or just to chase short-term mining interest?)

Technically, FIRO is still bumping against that $3 resistance. The daily RSI is in bullish territory, but also overbought, and there's a bearish divergence on the daily chart. Profit-taking could easily send the price tumbling. The article suggests watching the 38.2% Fibonacci retracement at $2.60. A dip below that could signal further decline.

The piece concludes by saying investors should watch how on-chain adoption for Spark Assets evolves. If it attracts cross-chain activity, FIRO may see steady utility-led demand. Conversely, a failed test could prompt deeper pullbacks. In other words, it's all up in the air.

Is Privacy Enough to Justify the Pump?

Look, FIRO has made some interesting moves, particularly with Spark Assets. But the data is still too thin to justify the recent price surge. The $3 resistance remains a major hurdle, and the overbought indicators suggest a correction is likely. The long-term success of FIRO hinges on whether Spark Assets can truly drive sustainable demand. Until I see concrete numbers, I'm staying on the sidelines.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

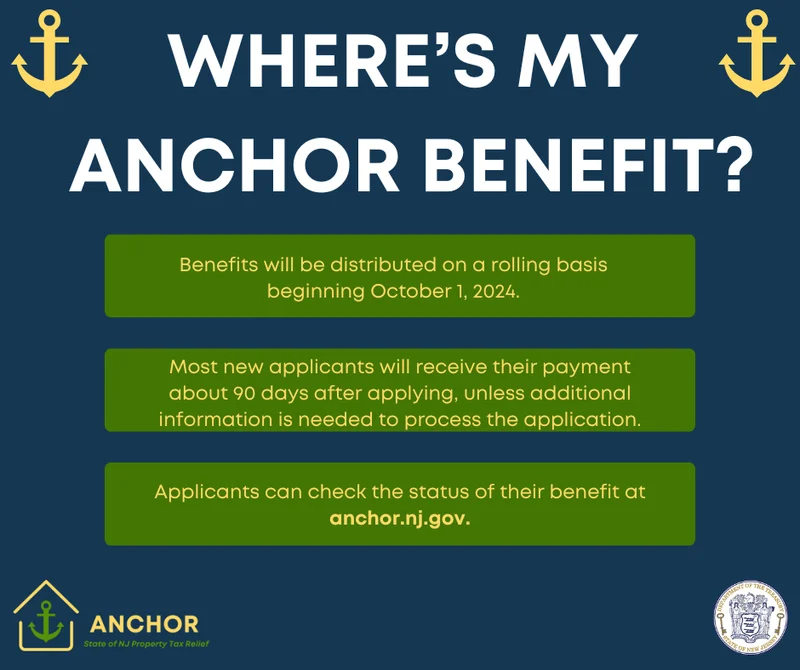

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Netflix Stock: Split Speculation and What It Means – What Reddit is Saying

- Saylor Moon: What's the Deal?

- World Liberty Financial, Trump, and Crypto: What's the Connection?

- Social Security Retirement Age Changes: What to Expect and the Impact – What Reddit is Saying

- Nvidia Stocks: AI Hype vs. Reality

- Ethereum Price: Plunge vs. Rally – What We Know

- Bitcoin's Bear Market: Liquidity Worries vs. Future Potential

- Nvidia Stock Price: What's Driving the Surge and What's Next

- Avelo Airlines' Route Shuffle: What's the Deal?

- Starlink Satellite Count: Orbit Numbers and Falling Concerns

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (6)

- investment advisor (4)

- crypto exchange binance (3)

- ethereum price (3)

- SX Network (3)