USPS Financial Loss Reforms: Mega Millions and What We Know

Generated Title: USPS's "Strategic Price Increases": A Losing Game?

The United States Postal Service just released its financial results for fiscal year 2025, and the picture isn't pretty. A net loss of $9.0 billion, while slightly improved from the previous year's $9.5 billion, still points to deep systemic problems. Postmaster General David Steiner talks about exploring "new revenue opportunities," but are strategic price increases really the answer, or just a temporary Band-Aid on a much larger wound?

The Illusion of Growth

Let's dive into the numbers. Total operating revenue increased by $916 million, or 1.2 percent, to $80.5 billion. The USPS attributes this to the growth of their USPS Ground Advantage service and, crucially, "strategic price increases." But here's where the narrative starts to crumble.

While First-Class Mail revenue did increase by $370 million (1.5 percent), that came at a cost of a 5.0 percent decrease in volume—2.2 billion fewer pieces of mail. Marketing Mail revenue also saw a similar pattern: a $350 million (2.3 percent) increase despite a 1.3 percent volume decline (764 million fewer pieces). Even Shipping and Packages, supposedly a growth area, saw revenue increase by only $315 million (1.0 percent) while volume plummeted by 5.7 percent (415 million pieces).

The core problem? They're charging more for fewer deliveries. This isn't growth; it's squeezing the last drops out of a dying sponge. Are these price increases sustainable? Will customers continue to absorb higher costs, or will they seek alternatives? I've seen this pattern before; it usually ends with customers jumping ship.

Digging Deeper into the Losses

The USPS is attempting to control costs, but it's a constant uphill battle. They tout $422 million in transportation expense reductions and a $1.1 billion decrease in workers’ compensation expense. But then, compensation and benefits expense increased by $1.7 billion, and other operating expenses rose by $221 million. It's like trying to bail out a boat with a hole in the bottom.

Chief Financial Officer Luke Grossmann highlights the "difficulties of our mandated cost structure." And this is the part of the report that I find genuinely puzzling. The USPS is burdened with legacy costs, particularly retiree pension and healthcare obligations. They’re seeking administrative and legislative reforms, including changes to retiree pension benefit funding rules. But how much of this is truly "mandated," and how much is simply a result of inefficient management and outdated business practices?

The report mentions an "incentivized voluntary early retirement offer to certain employees." While this might reduce short-term costs, what's the long-term impact on institutional knowledge and service quality? Are they losing experienced employees who can't easily be replaced?

It's a complex situation, no doubt. But the reliance on price hikes as a primary revenue driver strikes me as a dangerous game. It's a short-sighted strategy that risks alienating customers and accelerating the decline in mail volume. The USPS themselves have stated that, USPS: To correct our financial imbalances, we must explore new revenue opportunities.

Death by a Thousand Price Hikes

The USPS is in a tough spot, no question. But leaning so heavily on "strategic price increases" feels like a desperate move, not a strategic one. They're essentially betting that customers will continue to pay more for less service. That's a risky bet in a world with ever-increasing alternatives.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

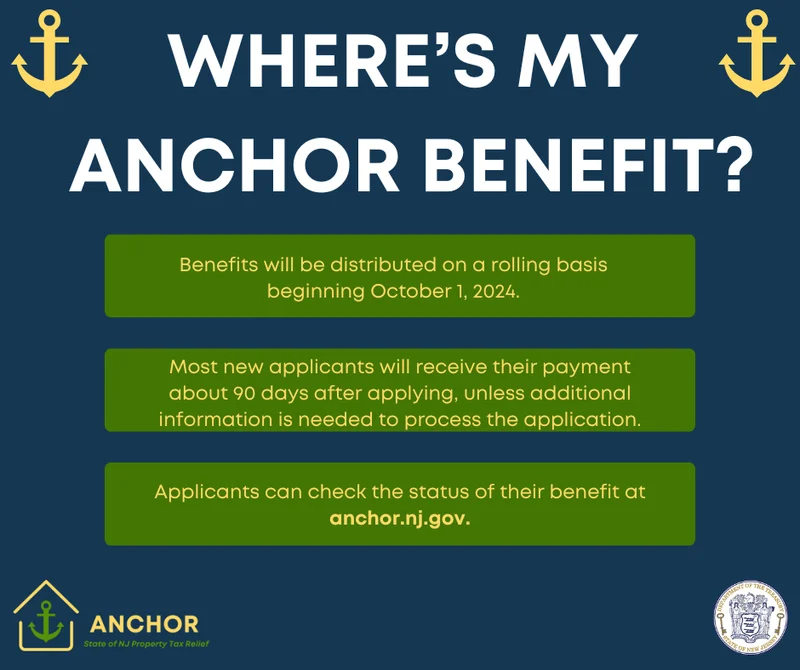

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Netflix Stock: Split Speculation and What It Means – What Reddit is Saying

- Saylor Moon: What's the Deal?

- World Liberty Financial, Trump, and Crypto: What's the Connection?

- Social Security Retirement Age Changes: What to Expect and the Impact – What Reddit is Saying

- Nvidia Stocks: AI Hype vs. Reality

- Ethereum Price: Plunge vs. Rally – What We Know

- Bitcoin's Bear Market: Liquidity Worries vs. Future Potential

- Nvidia Stock Price: What's Driving the Surge and What's Next

- Avelo Airlines' Route Shuffle: What's the Deal?

- Starlink Satellite Count: Orbit Numbers and Falling Concerns

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (6)

- investment advisor (4)

- crypto exchange binance (3)

- ethereum price (3)

- SX Network (3)