Nvidia's Internal Discord: Leadership Lessons vs. Client Disconnect

Nvidia's Software Sales: Hype vs. Reality?

Nvidia, fresh off hitting a $5 trillion market cap, is facing a classic tech company problem: hardware dominance doesn't automatically translate to software success. Internal emails reveal a struggle to sell Nvidia AI Enterprise (NVAIE) and other software products like Run:ai and Omniverse, despite the company’s overall astronomic rise. The challenge? A "fundamental disconnect" with clients, particularly in regulated industries. Nvidia's internal emails reveal a 'fundamental disconnect' with major software clients

The core issue seems to be Nvidia's sales team needing to develop a "comprehensive software story" around NVAIE. One email highlights the need for internal and external education, particularly for procurement and legal teams unfamiliar with Nvidia's software sales processes. Data security and indemnity obligations are sticking points, along with requests for higher damages caps than Nvidia is willing to offer.

Now, let's dig into the numbers. Nvidia is forecasting healthy software sales, with stand-alone software projected to hit 110% of sales targets in North and Latin America for Q3 fiscal 2026. However, software sold alongside hardware is expected to reach only 39% of its goal. Overall software sales forecasts were $78.7 million for the quarter, driven by NVAIE, which was forecast to hit 186% of the target. This discrepancy is telling. It suggests that while some clients are buying into Nvidia's software vision independently, others are less convinced when it's bundled with hardware.

The problem isn't necessarily the software itself; it's the perception of the software's value relative to the hardware. Nvidia's GPUs are the gold standard for AI, a near-monopoly. The software, on the other hand, faces competition from established players and open-source alternatives. Convincing clients to pay a premium for Nvidia's software ecosystem, especially when they're already heavily invested in Nvidia's hardware, requires a compelling value proposition.

And this is the part of the report that I find genuinely puzzling. If Nvidia's hardware is so dominant, why isn't the software selling itself? The answer likely lies in the different buying cycles and decision-makers involved. Hardware purchases are often driven by technical teams focused on performance, while software decisions involve legal and procurement teams concerned with risk and compliance. These teams have different priorities, and Nvidia needs to tailor its messaging accordingly.

Jensen Huang's leadership style, as highlighted in another article, emphasizes open communication and a "how hard can it be?" attitude. This optimism is admirable, but it needs to be tempered with a realistic assessment of the challenges in the enterprise software market. Huang’s mother teaching him English with just a dictionary is a great story, but selling complex AI software to risk-averse legal teams requires more than just grit. Jensen Huang Shares the Leadership Lesson His Mother Taught Him

The Goldman Sachs report mentioned in the article points to a broader trend of uneven AI adoption, with some companies viewing the technology as too early to deploy widely. Nvidia isn't alone in facing this challenge, but its high profile and lofty valuations make it a prime target for scrutiny. The company's success hinges on its ability to bridge the "fundamental disconnect" with clients and demonstrate the tangible value of its software offerings. What happens if Nvidia's software doesn't take off as projected? Will they adjust their strategy, or double down on pushing the integrated hardware/software approach?

A Software Story Still Being Written

Nvidia's software sales struggles are a symptom of a larger issue: the transition from a hardware-centric to a software-defined world. The company's hardware dominance provides a significant advantage, but it's not a guarantee of software success. Nvidia needs to adapt its sales strategy, address client concerns about risk and compliance, and articulate a compelling value proposition for its software offerings. Otherwise, the $78.7 million forecast might remain just that—a forecast.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

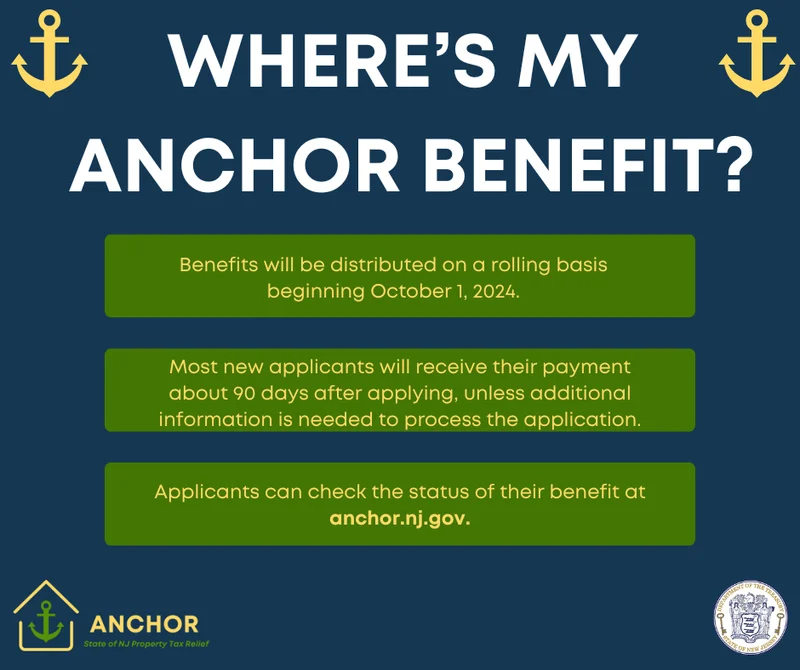

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Netflix Stock: Split Speculation and What It Means – What Reddit is Saying

- Saylor Moon: What's the Deal?

- World Liberty Financial, Trump, and Crypto: What's the Connection?

- Social Security Retirement Age Changes: What to Expect and the Impact – What Reddit is Saying

- Nvidia Stocks: AI Hype vs. Reality

- Ethereum Price: Plunge vs. Rally – What We Know

- Bitcoin's Bear Market: Liquidity Worries vs. Future Potential

- Nvidia Stock Price: What's Driving the Surge and What's Next

- Avelo Airlines' Route Shuffle: What's the Deal?

- Starlink Satellite Count: Orbit Numbers and Falling Concerns

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (6)

- investment advisor (4)

- crypto exchange binance (3)

- ethereum price (3)

- SX Network (3)