401k Contribution Limits 2026: What's Changing and Why You Still Can't Afford to Retire

Oh, Great, More Pennies from Heaven

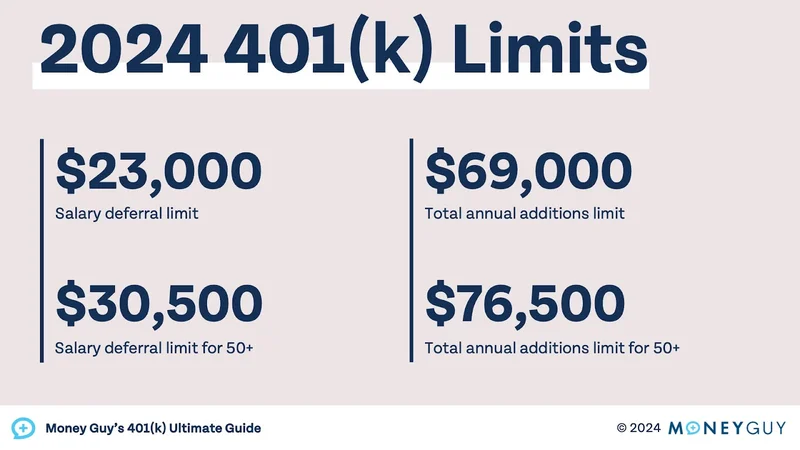

So, the IRS, bless their bureaucratic hearts, has decided to "raise" the 401(k) contribution limits for 2026. Cue the confetti, right? Wrong. Let's be real: a measly $1,000 increase to $24,500. That's it? In this economy? With inflation still acting like a toddler who's just discovered the sugar bowl? Give me a break.

They trot out this CPI number, 3% year-over-year, like it's some kind of victory. It ain't. It just means things are still costing more, only slightly slower than before. And the IRS uses the CPI ending in September for its calculations? Seriously? That's like steering a ship by looking at where you were three months ago.

And the IRA bump? A pathetic $500. I'm supposed to get excited about an extra $41.67 a month? That barely covers a decent cup of coffee these days. They expect us to be grateful for these crumbs?

The "Catch-Up" Is Just Catching Up to Reality

Okay, the "catch-up" contributions for those over 50 get a little love, too. An extra $500, bringing the total to $8,000. And the "super catch-up" for the 60-63 crowd? Stays the same at $11,250. Which, again, isn't exactly lighting the world on fire.

It's like they're dangling a carrot, trying to make us feel like we're making progress. But let's be honest: most people can't even afford to max out their 401(k)s in the first place. Are they living in the same reality as the rest of us?

I was at the grocery store the other day, and a head of lettuce was six bucks. Six bucks! What am I, a rabbit?

And don't even get me started on the income phase-out ranges for deductions. They nudge those up a little too, so slightly more people are eligible, but it's still a byzantine mess of rules and regulations that makes your head spin.

SECURE 2.0: More Like SECURE 0.2

They keep patting themselves on the back about the SECURE 2.0 Act. "Oh, we're helping older Americans save more!" Yeah, by letting them contribute a little bit extra when they're already staring down the barrel of retirement with empty bank accounts. It's like putting a Band-Aid on a gunshot wound.

The IRS says, "Participants in most 401(k), 403(b), governmental 457 plans and the federal government’s Thrift Savings Plan who are 50 and older generally can contribute up to $32,500 each year, starting in 2026." Generally? What does that even mean? Are there exceptions? Offcourse there are. There's always some kind of catch. You can read more about the new contribution limits in this article from Investment News.

Maybe I'm just too cynical. Maybe I should be grateful for these tiny little increases. But honestly, it feels like a slap in the face.

Is This the Best They Can Do?

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

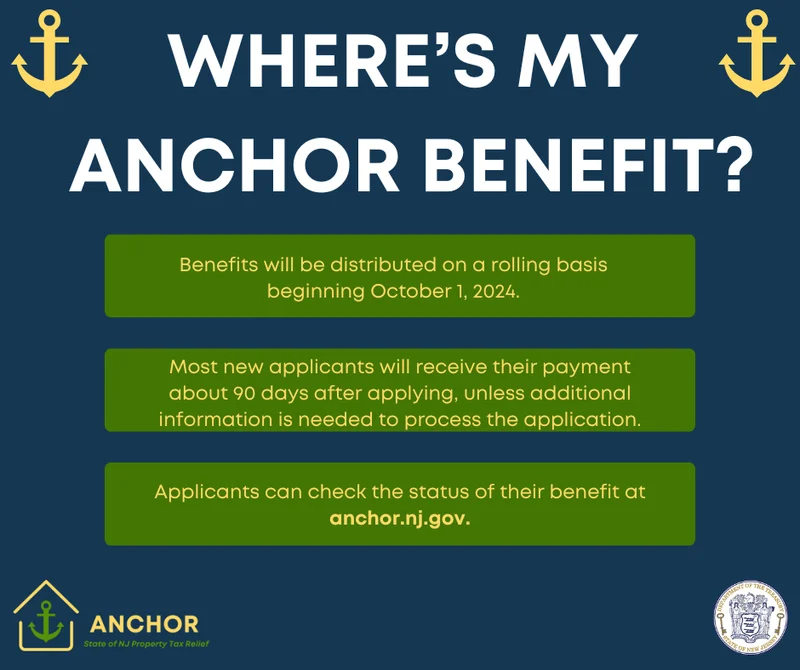

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

- Search

- Recently Published

-

- Netflix Stock: Split Speculation and What It Means – What Reddit is Saying

- Saylor Moon: What's the Deal?

- World Liberty Financial, Trump, and Crypto: What's the Connection?

- Social Security Retirement Age Changes: What to Expect and the Impact – What Reddit is Saying

- Nvidia Stocks: AI Hype vs. Reality

- Ethereum Price: Plunge vs. Rally – What We Know

- Bitcoin's Bear Market: Liquidity Worries vs. Future Potential

- Nvidia Stock Price: What's Driving the Surge and What's Next

- Avelo Airlines' Route Shuffle: What's the Deal?

- Starlink Satellite Count: Orbit Numbers and Falling Concerns

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (6)

- investment advisor (4)

- crypto exchange binance (3)

- ethereum price (3)

- SX Network (3)