Fastenal and the Edmonton Oilers: A New Partnership

Title: Fastenal's Fast Moves: Is This Growth Sustainable, or Just Fast Living?

Okay, let's dive into what's happening with Fastenal (FAST). Recent insider activity shows Director Stephen Eastman picking up 1,000 shares for just over $40,000. (That's roughly $40.81 a share, for those keeping score at home). Insider buys are generally a good sign, suggesting confidence in the company's future. But let’s not get carried away just yet.

Downgrades and Hockey Pucks: A Conflicting Picture

The analyst landscape is…mixed, to put it mildly. Wolfe Research downgraded FAST to "Underperform," citing decelerating sales and inflationary pressures squeezing gross margins. Bernstein chimed in with a similar "Underperform" rating, pointing to an "expensive relative valuation" and projecting earnings growth to peak and then slow down.

Now, here's where it gets interesting. Fastenal's Q3 earnings did show a robust 11.7% increase in net sales. So, is Wolfe Research wrong? Not necessarily. It's about the rate of change. An 11.7% increase is good, but is it good enough to justify the current valuation, especially if costs are rising faster?

And then there's the Edmonton Oilers partnership. Fastenal is now the "preferred MRO supply partner" for Rogers Place, the Oilers' home arena. They'll be providing tools, fasteners, and even janitorial supplies. Plus, rink-side ads and TV broadcast presence. It's a multi-year deal. On the surface, it sounds great, but let’s be real: How much does supplying an arena really move the needle for a $47 billion company? (That's the current market cap, give or take a few million).

I've looked at hundreds of these partnership announcements, and while the PR spin is always positive, it's tough to quantify the actual financial impact. Are we talking a few hundred thousand dollars a year? A million? Unless Fastenal suddenly becomes a household name because of hockey (unlikely, given what they sell), it feels more like marketing spend than a core growth driver.

Fastenal already being the official MRO sponsor of the NHL further dilutes the impact of this specific deal. Is there a synergistic effect, or just redundancy? NHL brings 75 sponsors into this weekend’s Global Series

Spark's Neutrality: A Data-Driven Compromise

TipRanks' AI Analyst, Spark, rates FAST as "Neutral." This seems like a cop-out at first glance, but digging deeper, it's a reasonable assessment. Spark highlights Fastenal's strong financial foundation and positive earnings call highlights (which are often carefully crafted narratives, mind you). However, the AI also flags bearish technical momentum and an expensive valuation.

Technical analysis is a whole other can of worms. While some traders swear by it, I tend to view it as more of a sentiment indicator than a crystal ball. Still, if enough people believe in the bearish momentum, it can become a self-fulfilling prophecy.

The core question is this: Can Fastenal maintain its growth trajectory while battling inflationary pressures and potential margin compression? The Q3 results were solid, but past performance is never a guarantee of future returns. The hockey deal is a nice PR boost, but the real drivers will be pricing strategies, cost management, and the overall health of the industrial sector.

And this is the part of the report that I find genuinely puzzling. The announcement with Edmonton Oilers was released on the same day as the insider activity (November 13, 2025). I would expect that the director would have this information before purchasing the stock. Is this a good sign? Fastenal Company Director Makes Significant Stock Purchase

The Valuation Just Doesn't Compute

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

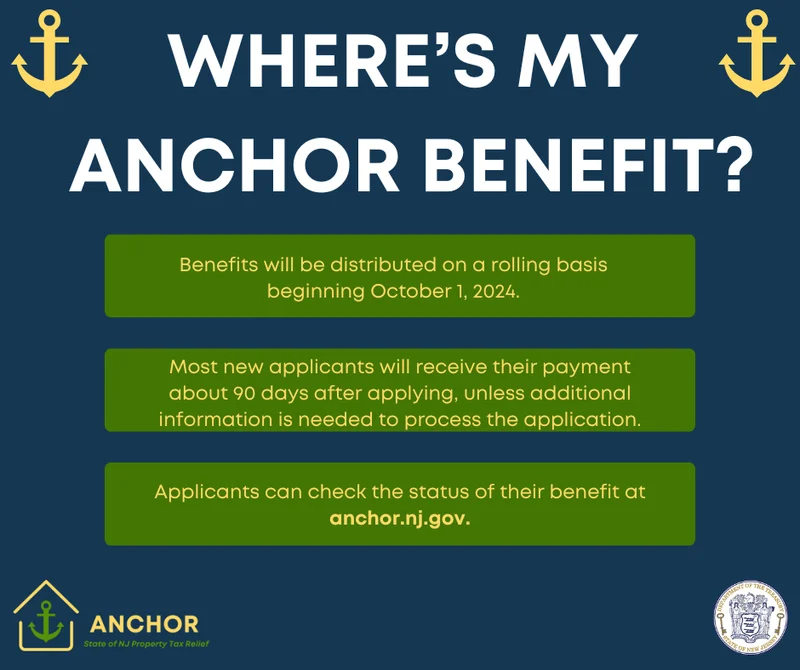

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Netflix Stock: Split Speculation and What It Means – What Reddit is Saying

- Saylor Moon: What's the Deal?

- World Liberty Financial, Trump, and Crypto: What's the Connection?

- Social Security Retirement Age Changes: What to Expect and the Impact – What Reddit is Saying

- Nvidia Stocks: AI Hype vs. Reality

- Ethereum Price: Plunge vs. Rally – What We Know

- Bitcoin's Bear Market: Liquidity Worries vs. Future Potential

- Nvidia Stock Price: What's Driving the Surge and What's Next

- Avelo Airlines' Route Shuffle: What's the Deal?

- Starlink Satellite Count: Orbit Numbers and Falling Concerns

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (6)

- investment advisor (4)

- crypto exchange binance (3)

- ethereum price (3)

- SX Network (3)