MSTR Stock's Wild Ride: What's Happening and the Bitcoin Connection

Strategy Shares Plunge: Is This a Bitcoin Buying Opportunity in Disguise?

It’s been a bumpy ride for Strategy (formerly MicroStrategy), hasn’t it? The stock has taken a beating, and you’re seeing headlines screaming about losses and a potential "death spiral." But hold on a second. Before you jump ship, let’s take a closer look, because sometimes, the biggest opportunities are hiding in plain sight during these moments of panic.

What's happening with Strategy isn't just about a company's stock price; it’s a fascinating case study in how traditional markets are grappling with the rise of decentralized finance. Strategy made a bold bet on Bitcoin, amassing a significant reserve. Now, its fate is inextricably linked to the cryptocurrency's performance, which is a relationship that’s as exciting as it is volatile. We have to remember that as Bitcoin dips, so does Strategy's perceived value, leading to shareholder jitters and, frankly, some overblown fear.

The Bitcoin Pendulum: Risk vs. Reward

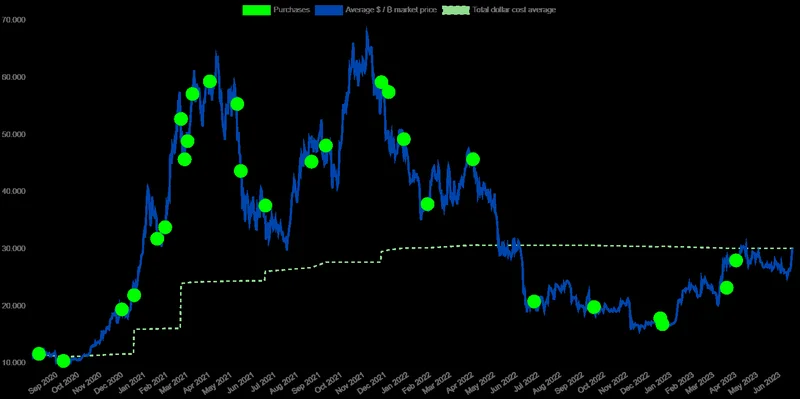

The core issue is this: Strategy’s stock price is now heavily correlated with Bitcoin's price. When Bitcoin sneezes, Strategy catches a cold – or so the saying goes. The recent decline in Bitcoin has sent Strategy's stock tumbling, with some analysts pointing to a concerning multiple-to-net-asset-value (mNAV) approaching 1. This means the company's shares are being valued closer and closer to the value of its Bitcoin holdings, minus debt. And that's got some short-sellers circling, ready to pounce. MicroStrategy stock drops 60% from peak as mNAV approaches 1

But here's where things get interesting. This correlation, while currently painful, also presents a massive opportunity. Imagine Bitcoin rebounds, and it will. When it does, Strategy’s stock is primed to skyrocket even faster. It's like a coiled spring, ready to unleash stored potential energy. The company's guidance, now heavily tied to Bitcoin’s performance, anticipates a year-end Bitcoin price of $150,000. If that happens, those who held on will be handsomely rewarded, and those who invested during this dip will be sitting pretty.

Now, some might argue that it’s better to invest directly in Bitcoin or a crypto ETF. And that's a fair point, but here's something most people miss: Strategy offers exposure to Bitcoin with a twist. It's not just about holding the asset; it's about a company actively managing and leveraging its Bitcoin holdings. And let's not forget Michael Saylor's unwavering commitment – his "HODL" message, complete with the image of a burning ship, speaks volumes about his long-term vision. (That's the kind of leadership that inspires confidence, even when the seas are rough). When I saw that, I knew that this wasn't a company about to flinch at the first sign of trouble.

Of course, there are risks. Strategy’s debt is rising, and its reliance on capital raises to fund Bitcoin purchases is causing share dilution – in simpler terms, it means existing shareholders own a smaller piece of the pie. And that’s a valid concern. But it’s a calculated risk, a trade-off for the potential upside.

This reminds me of the early days of the internet. Companies that bet big on the web faced skepticism and volatility, but those that persevered reaped enormous rewards. Is Strategy making a similar bet on the future of finance? I think so. The company's enterprise software business, while shrinking, still contributes to its top line. It's not a one-trick pony; it's a tech company adapting to a new world, leveraging Bitcoin as a strategic asset.

The situation also brings up some important questions. What happens if Strategy’s mNAV falls below 1? Will they be forced to sell Bitcoin to buy back equity, as some analysts suggest? And if so, could this trigger a "death spiral," as some traders fear? Maybe. But it's also possible that such a move could create a buying opportunity for those who understand the long-term potential of Bitcoin.

The community seems to agree. I've been seeing some very insightful comments on Reddit and other platforms, with many users viewing this dip as a chance to increase their holdings. They see the bigger picture: Strategy isn't just a stock; it's a proxy for Bitcoin adoption, a bet on the future of decentralized finance.

This Dip is a Launchpad

So, what does this all mean? Strategy's current struggles are a reflection of the market's uncertainty about Bitcoin and its role in the future of finance. But for those with a long-term vision, this could be a golden opportunity to buy into a company that is uniquely positioned to benefit from the continued rise of cryptocurrency. The key is to do your own research, understand the risks, and make an informed decision. But don't let fear cloud your judgment, because sometimes, the greatest rewards come from embracing the unknown.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

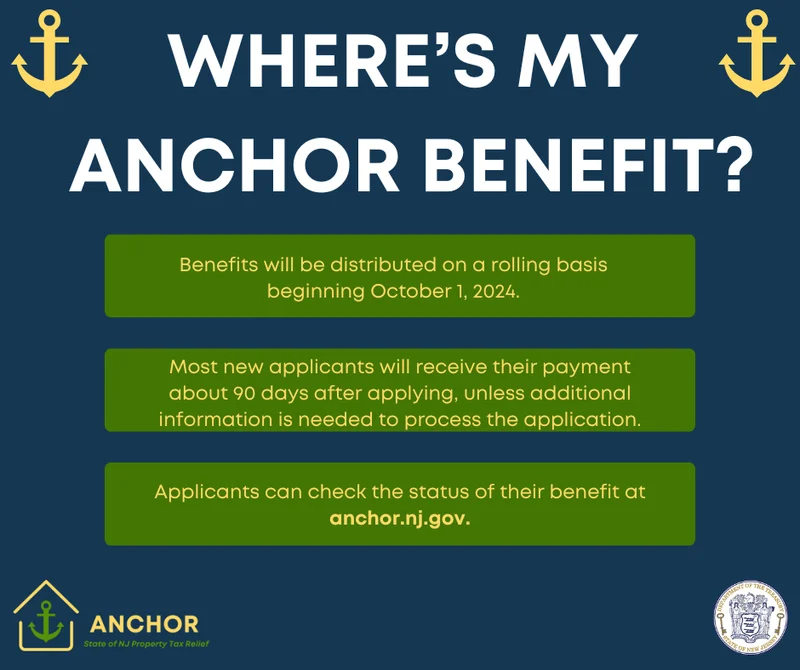

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Netflix Stock: Split Speculation and What It Means – What Reddit is Saying

- Saylor Moon: What's the Deal?

- World Liberty Financial, Trump, and Crypto: What's the Connection?

- Social Security Retirement Age Changes: What to Expect and the Impact – What Reddit is Saying

- Nvidia Stocks: AI Hype vs. Reality

- Ethereum Price: Plunge vs. Rally – What We Know

- Bitcoin's Bear Market: Liquidity Worries vs. Future Potential

- Nvidia Stock Price: What's Driving the Surge and What's Next

- Avelo Airlines' Route Shuffle: What's the Deal?

- Starlink Satellite Count: Orbit Numbers and Falling Concerns

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (6)

- investment advisor (4)

- crypto exchange binance (3)

- ethereum price (3)

- SX Network (3)